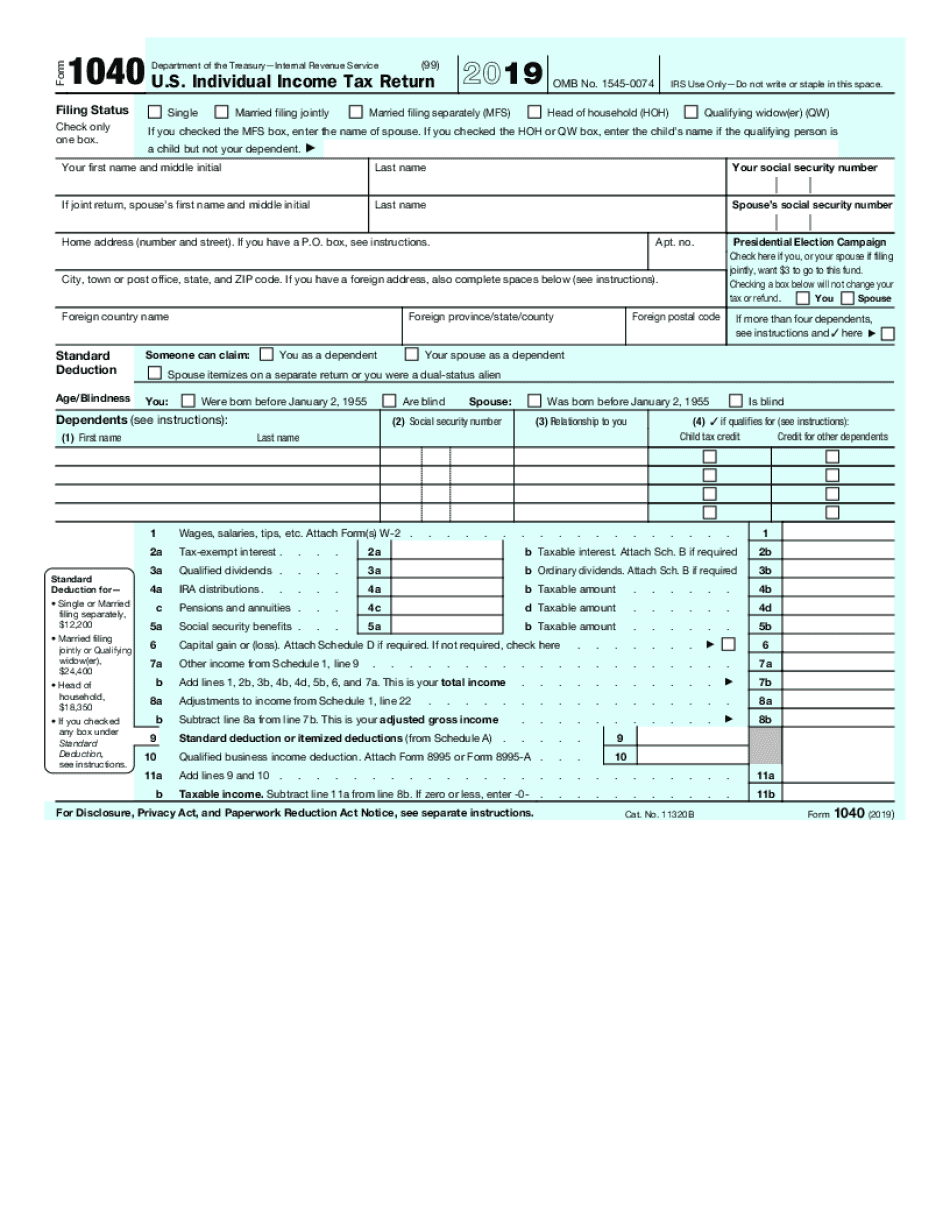

Tax Tip: e-file something - return or extension - even if you can't pay anything! Why? Less penalties! If you owe taxes, you would not owe late filing penalties, but you could be subject to late payment penalties. If you miss this deadline you have until October 15 following the April 15 date regardless of if you e-filed a tax extension. Prepare and e-file your IRS and state current year tax return(s) by April 15 following a given tax year. See our state tax page for state forms and addresses. Use these free online, fillable forms to complete your 2020 Return before you sign, print, and mail your return to the 2020 IRS address.

To file 2020 Taxes for free, start with the 2020 Tax Calculator to estimate your 2020 Return before filling out the 2020 Tax Forms listed below - or, you can search for tax forms. This also applies to 2020 state income tax returns.

As of October 15, 2021, IRS income tax forms and schedules for Tax Year 2020 can no longer be e-filed, thus 2020 Taxes can only be mailed in on paper forms.

0 kommentar(er)

0 kommentar(er)